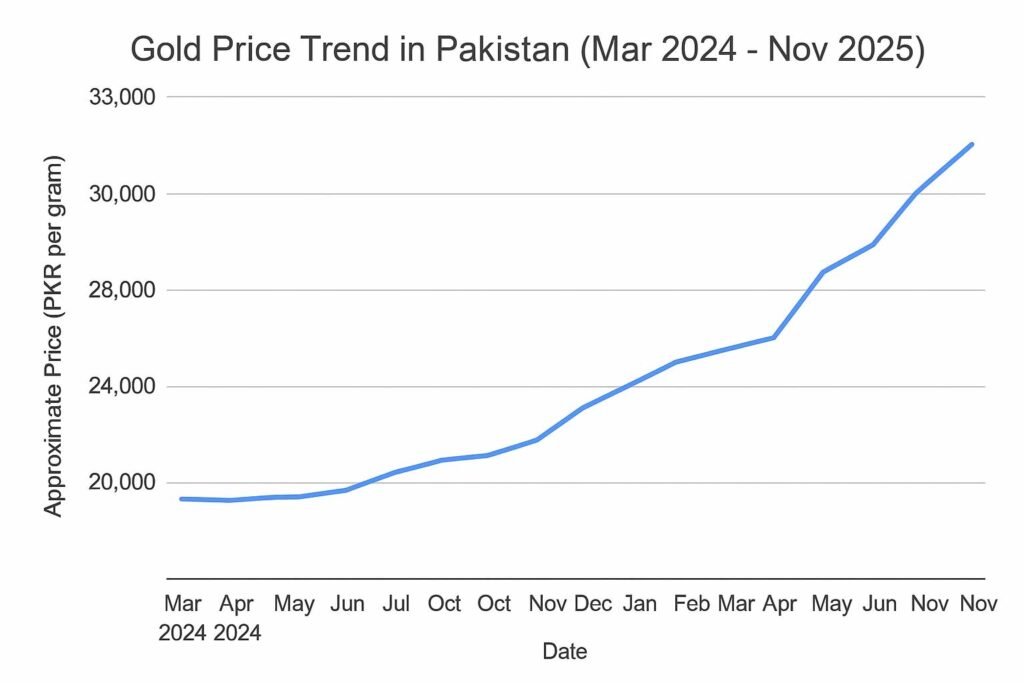

If you’ve been following the gold rate in Pakistan, you’ve probably noticed how its price swings sharply, sometimes within days. From a trading price of around PKR 19,000 per gram in early 2024 to over PKR 36,000 per gram in November 2025, gold prices have risen steadily.

These gains are rarely random. They’re tied to the rupee’s strength, inflation, global demand, and a few other moving parts that keep Pakistan’s gold prices on edge.

What Really Drives Gold Prices

While the average Pakistani consumer sees gold as an investment option for just jewellery, internationally, Gold demand is not just about jewellery; it’s a financial mirror reflecting how stable or uncertain the economy feels.

In Pakistan, the price per gram moves according to five main forces: global market prices (in USD), the USD-PKR exchange rate, local demand and supply, inflation trends, and government import policies. When any of these move, gold reacts.

The Data: Gold Prices in Pakistan (2024–2025)

The table below shows how 24K gold prices have changed month to month, based on average market data from GoldPriceToday.pk, Gold World, and Exchange-Rates. It gives a clear view of how rapidly prices have risen in the past two years.

| Month | PKR per gram | Monthly % Change | % Change Since Mar 2024 |

| 2024-03 | 19335 | – | 0.00 |

| 2024-04 | 20518 | 6.12 | 6.12 |

| 2024-05 | 20557 | 0.19 | 6.32 |

| 2024-06 | 20672 | 0.56 | 6.91 |

| 2024-07 | 21480 | 3.91 | 11.09 |

| 2024-08 | 22200 | 3.35 | 14.82 |

| 2024-09 | 22850 | 2.93 | 18.18 |

| 2024-10 | 23410 | 2.45 | 21.08 |

| 2024-11 | 23980 | 2.43 | 24.02 |

| 2024-12 | 24239 | 1.08 | 25.36 |

| 2025-01 | 23550 | -2.84 | 21.80 |

| 2025-02 | 25300 | 7.43 | 30.85 |

| 2025-03 | 26300 | 3.95 | 36.02 |

| 2025-04 | 28400 | 7.98 | 46.88 |

| 2025-05 | 30700 | 8.10 | 58.78 |

| 2025-06 | 29400 | -4.23 | 52.06 |

| 2025-07 | 30400 | 3.40 | 57.23 |

| 2025-08 | 31200 | 2.63 | 61.37 |

| 2025-09 | 31600 | 1.28 | 63.43 |

| 2025-10 | 34890 | 10.41 | 80.45 |

| 2025-11 | 36335 | 4.14 | 87.92 |

Source: GoldPriceToday.pk, Gold World, Exchange-Rates (converted to PKR per gram).

Understanding the Ups and Downs

If we look closely, every gold rally in Pakistan has coincided with a weak rupee. For example, when the USD-PKR rate climbed from around PKR 285 in early 2024 to nearly PKR 310 by mid-2025, local gold jumped by more than 40%.

This isn’t a fluke; gold in Pakistan trades in rupee terms, but is priced internationally in dollars. So when the rupee weakens, even if the global price stays flat, local buyers pay more.

Another global factor was US monetary policy. Each time the Federal Reserve is expected to keep interest rates higher, international gold prices saw short-term dips. But during uncertain (high-risk) periods, like global conflicts, shipping disruptions, or stock market turbulence, investors shift their money into gold as a safe haven investment. This pushes up global gold demand and consequently impacts prices in Pakistan.

This pattern was visible in mid-2025, when global investors moved towards defensive investing after economic slowdowns in Europe and China. As a result, gold crossed USD 2,400 per ounce globally, and in Pakistan, the per tola price surged past PKR 390,000.

So, while local conditions matter, Pakistan’s gold market is also deeply tied to the pulse of international finance.

The Role of Local Demand

Local trends amplify these movements. Pakistan’s gold buying is traditionally driven, from weddings to Eid gifting, so it’s seasonal. For example, the wedding seasons of December to March and June toAugust are typical high-demand months. Jewellers in Karachi, Lahore, and Multan often report supply shortages during these periods, which result in small premiums added to the spot price.

Moreover, the shift in consumer behavior toward investment-grade gold (bars and biscuits) has grown over the last few years. Data from the Pakistan Bureau of Statistics (PBS) shows that jewellery demand dipped due to high making charges. However, demand for raw gold as a savings asset is also on the rise. Many middle-income households now prefer small gold bars or even digital gold investments as a hedge against inflation.

In 2025, this behavior was more prominent as inflation in Pakistan touched double digits again. For many families, gold felt safer than bank deposits, which were barely keeping up with inflation. This shift in mindset contributed to steady local demand and kept prices high.

What the Data Tells Us

Between March 2024 and November 2025, gold rose by roughly 88% in PKR terms. Monthly data show sharper jumps in early 2025, coinciding with global price increases and rupee depreciation. By September 2025, Pakistan saw record highs, around PKR 391,000 per tola, as reported by MettisGlobal.

The Human Side of Gold Prices

For most Pakistanis, gold is the baseline of financial security. When the economy feels uncertain, people turn to gold. But that emotional link also feeds price spikes when sentiments are running high.

A smart approach is to track the USD-PKR trend and international gold levels before buying. A better time to buy is when the rupee strengthens or global gold prices drop.

Key Takeaways

- Gold prices move with the dollar, inflation, and sentiment.

- A weaker rupee almost always means higher gold prices.

- Global crises, central bank moves, and trade costs play their part.

- Watching both the rupee and international trends can help buyers plan better.

Final Thoughts

Gold is going to hold a special place in Pakistan’s savings habits. It’s not just another investment. For most families, it’s a form of security that feels real and dependable. Prices might rise or fall from month to month, but over time, gold tends to mirror the country’s larger economic story, how the rupee behaves, how inflation bites, and how confident people feel about the future.

For anyone keeping an eye on the market, it helps to look beyond the daily headlines. Sudden spikes often have short-term triggers like currency swings or changes in global interest rates. But the broader pattern tells an honest tale: when uncertainty grows, gold becomes the comfort zone for savers.

In simple terms, watching gold is like watching a thermometer for the economy. If the rupee weakens or inflation climbs, prices will likely stay firm. But when stability returns, gold usually cools off a little. For ordinary investors, that means timing matters; gradual, consistent buying often works better than chasing every new peak.

So while no one can predict the perfect time to buy, one thing is clear: in Pakistan’s economic landscape, gold isn’t going anywhere. It will continue to shine quietly in lockers, dowries, and digital wallets, a traditional asset that still speaks the language of trust and stability.